Compound Tax Explained

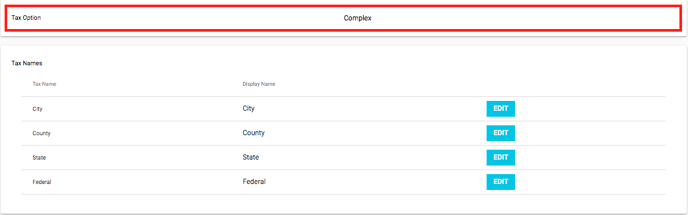

The option to "Compound" tax rates, is only available when the "Tax Option" is switched from "Regular" to "Complex." This same switch will enable the specific shop to specify "Tax rates" per consumer type (Adult-Use vs Medicinal - MMIC vs Medicinal - Third Party).

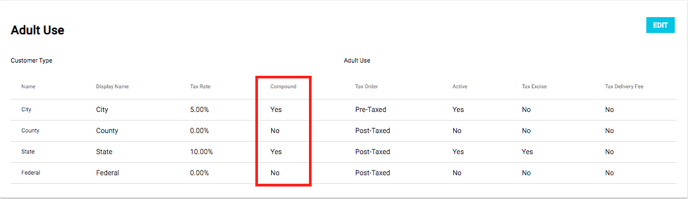

It is important to keep in mind the order in which the rates will be applied. Currently, the rates will be calculated starting at the top, moving down sequentially, based on the "active rates."

City - Compound = Yes does not do anything, there are no taxes to compound on top of.

County - Compound Yes = It will compound on top of City and any other Tax rates entered in State or Fed will Compound onto City as well.

State - Compound Yes = it will compound on the next tax rate above it (county or if no rate in county then city) and Federal will also be compounded on these rates as well.

Federal - Compound Yes = it will compound on the next tax rate above it (State or if no rate for state then, county or if no rate in county, then city)

The "Compound" feature, which is pictured below, relates directly to the specific tax rate on the line.

- This Compound feature will change the way your individual tax rates interact with each other.

By setting any of the specific rates to be "Yes," it will cause the rate above it to calculate a "new subtotal," before calculating the tax for that Tax Rate.

With the Compound Feature set to "No," the Tax Rates will be treated as a "sum" that is applied to the Subtotal, after discounts. This sum will then be broken down and displayed according to the specific rates.

- Typical configurations are either all compounded or none compounded.

It is important that you work with your tax professionals and perform some test transactions, to make sure you are getting the expected calculations.

Example Compound Tax Calculation

- Final Subtotal: $200

- City: 5%

- County: 7.75%

- State: 15%

- Non-compound: $200 x (5 + 7.75 + 15)% = $200 x 27.75% = final cost

- Compound: (($200 x 5%) x 7.75%) x 15% = final cost